Short Answer

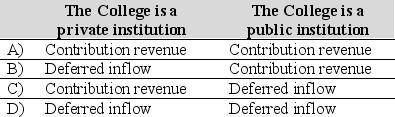

In December 2016, a donor to a college established a trust in which college receives $ 500,000 to be invested. The college receives $ 4,000 of the income per year until the donor dies. At that point, the assets revert to the donor's estate. The college estimates that the present value of the anticipated receipts from the trust amount to $ 120,000. How should this $ 120,000 be recorded in 2016, assuming

Correct Answer:

Verified

C

Explanation: Private sector colleges r...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Explanation: Private sector colleges r...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q57: Public institutions of higher education are required

Q58: With respect to colleges and universities, if

Q59: Record the following transactions on the books

Q60: Public and private colleges account for split-interest

Q61: Revenue for reimbursement grants may be recognized

Q63: Private colleges and universities recognize contribution revenue

Q64: Public higher education institutions that report as

Q65: Private colleges and universities are required to

Q66: Private colleges and universities are required to

Q67: Sam Smith died, leaving a will that