Short Answer

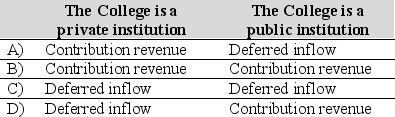

In December 2016 a donor to a college established a trust in which college receives $ 5,000,000 to be invested. The donor's spouse is to receive $ 40,000 of the income per year for ten years. At that point, the assets and income revert to the college. The college estimates that the present value of the anticipated receipts from the trust amount to $ 4,800,000. How should this $ 4,800,000 be recorded in 2016, assuming

Correct Answer:

Verified

A

Explanation: Private sector colleges r...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Explanation: Private sector colleges r...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q72: NACUBO has issued a position paper titled

Q73: Match the Type of Entity with the

Q74: Generally speaking, accounting standards for private colleges

Q75: Which of the following statements is true

Q76: Which of the following would <u><b>not </b></u>

Q78: Financial statements prepared for public colleges and

Q79: Scholarships tuition discounts) provided to students where

Q80: Public colleges and universities follow _ guidelines

Q81: Western State University, a public university,

Q82: FASB standards require private not-for-profit colleges and