Essay

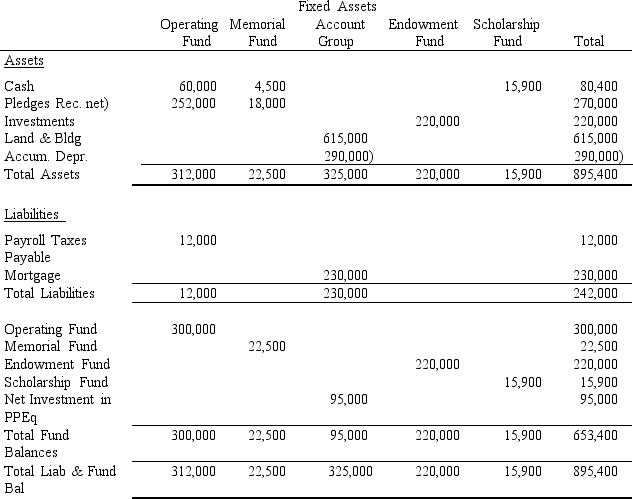

Union Seminary, a private not-for-profit college, uses the fund basis of accounting for internal record keeping. Presented below is the fully adjusted 12/31/2017 balance sheet for Union, prepared using funds and account groups. The following are fund descriptions:

Operating Fund - the fund used for transactions not falling within the definition of other funds. There are no restrictions on these resources.

Memorial Fund - Used to account for resources donated from outside parties for specific capital additions

Endowment Fund - Assets received from an outside donor for permanent investment, only the earnings may be expended.

Scholarship Fund - Cash set aside by the Seminary's governing board for use as scholarships and student aid.

Fixed Assets Account Group - A record of the Seminary's fixed assets and long-term debt.

Required: Prepare a Statement of Financial Position following the guidelines provided in FASB Statements 116 and 117 for private not-for-profits and assuming Union does not classify plant assets as temporarily restricted.

Correct Answer:

Verified

* 300,000...

* 300,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Western State University, a public university,

Q82: FASB standards require private not-for-profit colleges and

Q83: A tuition waiver for a student who

Q84: Which of the following would be true

Q85: Which of the following is true regarding

Q87: A college borrows money to construct a

Q88: Which of the following is <u><b>not </b></u>

Q89: For private colleges and universities, reclassifications of

Q90: Higher education institutions that report as engaged

Q91: Which of the following is true regarding