Multiple Choice

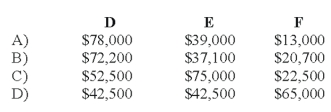

The DEF partnership reported net income of $130,000 for the year ended December 31, 2008. According to the partnership agreement, partnership profits and losses are to be distributed as follows:  How should partnership net income for 2008 be allocated to D, E, and F?

How should partnership net income for 2008 be allocated to D, E, and F?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q1: In the AD partnership, Allen's capital is

Q3: When a new partner is admitted into

Q6: Net income for Levin-Tom partnership for 2009

Q11: Which of the following statements best describes

Q18: A joint venture may be organized as

Q20: When a new partner is admitted into

Q40: Apple and Betty are planning on beginning

Q43: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q51: In the AD partnership,Allen's capital is $140,000

Q69: In the RST partnership,Ron's capital is $80,000,Stella's