Multiple Choice

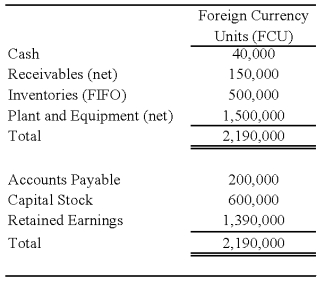

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:

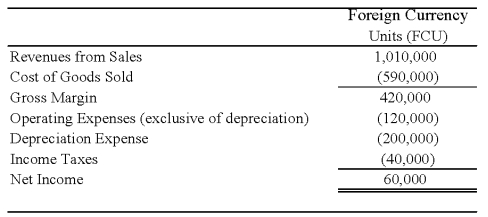

Perth's income statement for 20X8 is as follows:

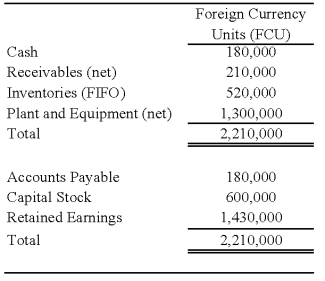

The balance sheet of Perth at December 31, 20X8, is as follows:

The balance sheet of Perth at December 31, 20X8, is as follows:

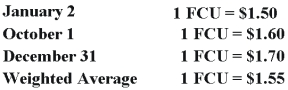

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming Perth's local currency is the functional currency,what is the amount of translation adjustment that appears on Johnson's consolidated financial statements at December 31,20X8?

A) $419,184 credit

B) $416,884 credit

C) $405,884 debit

D) $398,500 credit

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Michigan-based Leo Corporation acquired 100 percent of

Q8: Nichols Company owns 90% of the capital

Q12: All of the following describe the International

Q16: Parent Company's wholly-owned subsidiary,Son Corporation,maintains its accounting

Q17: The balance in Newsprint Corp.'s foreign exchange

Q22: Gains from remeasuring a foreign subsidiary's financial

Q23: Which of the following defines a foreign-based

Q25: On January 1,20X8,Pullman Corporation acquired 75 percent

Q33: On October 15,20X1,Planet Company sold inventory to

Q48: Dividends of a foreign subsidiary are translated