Multiple Choice

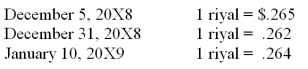

On December 5, 20X8, Texas based Imperial Corporation purchased goods from a Saudi Arabian firm for 100,000 riyals (SAR) , to be paid on January 10, 20X9. The transaction is denominated in Saudi riyals. Imperial's fiscal year ends on December 31, and its reporting currency is the U.S. dollar. The exchange rates are:

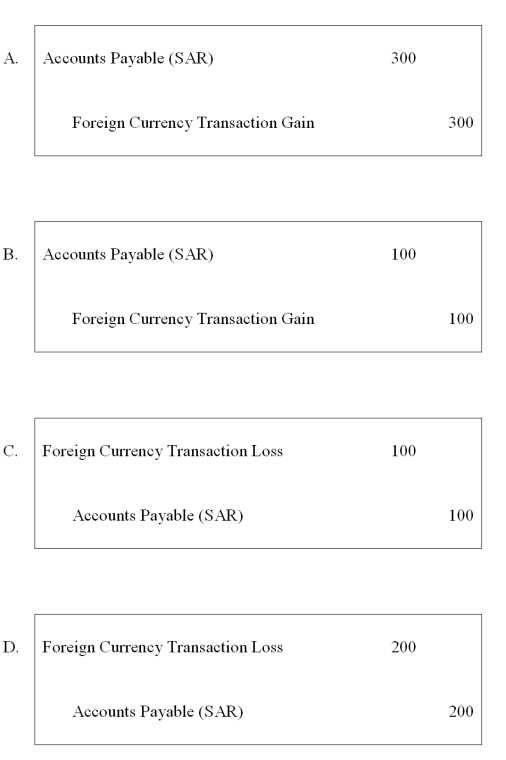

-Based on the preceding information, what journal entry would Imperial make on January 10, 20X9, to revalue foreign currency payable to equivalent U.S. dollar value?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which of the following observations is true

Q9: Company X denominated a December 1,20X9,purchase of

Q12: Taste Bits Inc. purchased chocolates from Switzerland

Q21: Taste Bits Inc. purchased chocolates from Switzerland

Q35: On December 1, 20X8, Winston Corporation acquired

Q38: Spiraling crude oil prices prompted AMAR Company

Q40: Suppose the direct foreign exchange rates in

Q40: On December 1, 2008, Merry Corporation acquired

Q47: If 1 British pound can be exchanged

Q60: Taste Bits Inc. purchased chocolates from Switzerland