Multiple Choice

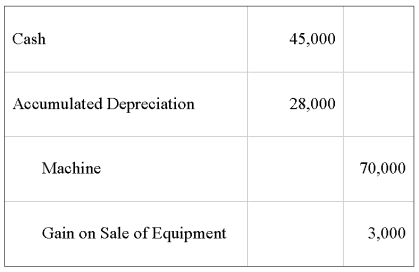

On January 1,20X7,Servant Company purchased a machine with an expected economic life of five years.On January 1,20X9,Servant sold the machine to Master Corporation and recorded the following entry:

Master Corporation holds 75 percent of Servant's voting shares.Servant reported net income of $50,000,and Master reported income from its own operations of $100,000 for 20X9.There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

-Based on the preceding information,in the preparation of the 20X9 consolidated income statement,depreciation expense will be:

A) Debited for $1,000 in the eliminating entries.

B) Credited for $1,000 in the eliminating entries.

C) Debited for $15,000 in the eliminating entries.

D) Credited for $15,000 in the eliminating entries.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A wholly owned subsidiary sold land to

Q19: Pint Corporation holds 70 percent of Size

Q21: Phobos Company holds 80 percent of Deimos

Q21: On January 1,20X7,Server Company purchased a machine

Q23: On January 1,20X7,Server Company purchased a machine

Q26: Using the fully adjusted equity method,an intercompany

Q35: Parent Corporation purchased land from S1 Corporation

Q37: A parent and its 80 percent-owned subsidiary

Q40: Postage Corporation receives management consulting services from

Q54: Pat Corporation acquired 80 percent of Smack