Essay

On January 1, 20X8, Vector Company acquired 80 percent of Scalar Company's ownership on for $120,000 cash. At that date, the fair value of the noncontrolling interest was $30,000. The book value of Scalar's net assets at acquisition was $125,000. The book values and fair values of Scalar's assets and liabilities were equal, except for buildings and equipment, which were worth $15,000 more than book value. Buildings and equipment are depreciated on a 10-year basis. Although goodwill is not amortized, the management of Vector concluded at December 31, 20X8, that goodwill from its acquisition of Scalar shares had been impaired and the correct carrying amount was $5,000. Goodwill and goodwill impairment were assigned proportionately to the controlling and noncontrolling shareholders. No additional impairment occurred in 20X9.

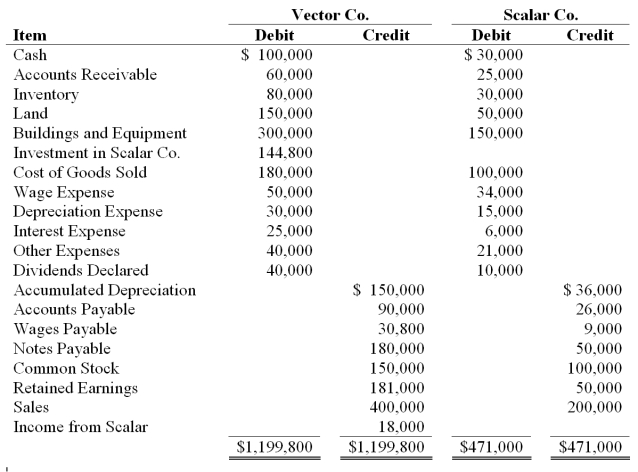

Trial balance data for Vector and Scalar on December 31, 20X9, are as follows:  Required:

Required:

1) Provide all eliminating entries needed to prepare a three-part consolidation worksheet as of December 31, 20X9.

2) Prepare a three-part consolidation worksheet for 20X9 in good form.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: The following information applies to Questions 29-31<br>On

Q14: Pink Inc.sells half of its 70% interest

Q18: When a parent owns less than 100%

Q19: On December 31,20X8,Peak Corporation acquired 80 percent

Q20: On January 1, 20X8, Ramon Corporation acquired

Q27: On January 1,20X9,Pirate Corporation acquired 80 percent

Q29: The following information applies to Questions 21-26<br>On

Q40: The following information applies to Questions 21-26<br>On

Q43: The following information applies to Questions 29-31<br>On

Q52: The following information applies to Questions 29-31<br>On