Essay

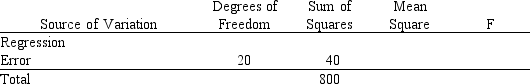

Below you are given a partial ANOVA table relating the price of a company's stock (y in dollars), the Dow Jones industrial average (x1), and the stock price of the company's major competitor (x2 in dollars).

a.What has been the sample size for this regression analysis?

b.At = 0.05 level of significance, test to determine if the model is significant. That is, determine if there exists a significant relationship between the independent variables and the dependent variable.

c.Determine the multiple coefficient of determination.

Correct Answer:

Verified

a.23

b.F = 190 > 3.4...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.F = 190 > 3.4...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Exhibit 13-8<br>The following estimated regression model

Q7: The correct relationship between SST, SSR, and

Q19: Exhibit 13-5<br>Below you are given a partial

Q21: Exhibit 13-3<br>In a regression model involving 30

Q23: The following regression model has been proposed

Q26: Exhibit 13-4<br>a.<br>y = <font face="symbol"></font><sub>0</sub> + <font

Q29: A student used multiple regression analysis to

Q51: The numerical value of the coefficient of

Q55: Exhibit 15-8<br>The following estimated regression model was

Q63: In regression analysis, an outlier is an