Essay

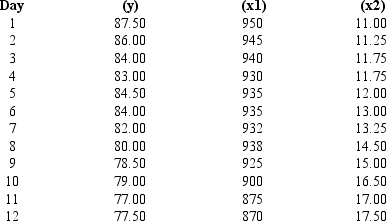

The prices of Rawlston, Inc. stock (y) over a period of 12 days, the number of shares (in 100s) of company's stocks sold (x1), and the volume of exchange (in millions) on the New York Stock Exchange (x2) are shown below.

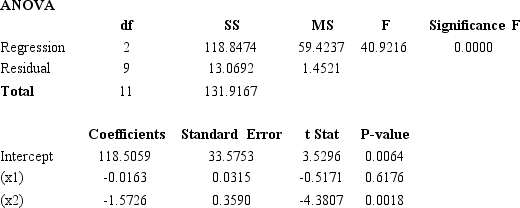

Excel was used to determine the least-squares regression equation. Part of the computer output is shown below.

Excel was used to determine the least-squares regression equation. Part of the computer output is shown below.

a.Use the output shown above and write an equation that can be used to predict the price of the stock.

b.Interpret the coefficients of the estimated regression equation that you found in Part

c.At 95% confidence, determine which variables are significant and which are not.

d.If in a given day, the number of shares of the company that were sold was 94,500 and the volume of exchange on the New York Stock Exchange was 16 million, what would you expect the price of the stock to be?

Correct Answer:

Verified

a. = 118.5055 - 0.0163x1 - 1.5726x2

= 118.5055 - 0.0163x1 - 1.5726x2

b.As th...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.As th...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Exhibit 13-1<br>In a regression model involving

Q43: In a multiple regression analysis involving 10

Q50: Exhibit 13-8<br>The following estimated regression model

Q60: Below you are given a partial ANOVA

Q64: Below you are given a partial Excel

Q65: A regression model involving 3 independent variables

Q72: Exhibit 13-8<br>The following estimated regression model

Q77: A regression model involved 18 independent variables

Q90: In a multiple regression model, the

Q105: Exhibit 13-8<br>The following estimated regression model