Multiple Choice

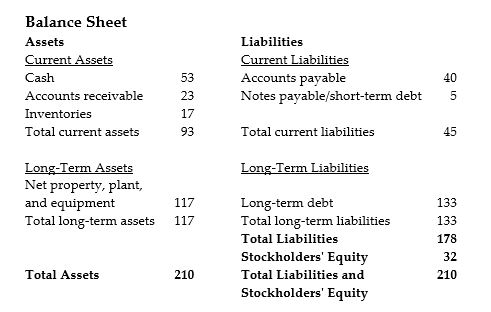

The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. If the company has 5 million shares outstanding, and these shares are trading at a price of $6.39 per share, what does this tell you about how investors view this firm's book value?

The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. If the company has 5 million shares outstanding, and these shares are trading at a price of $6.39 per share, what does this tell you about how investors view this firm's book value?

A) Investors consider that the firm's market value is worth very much less than its book value.

B) Investors consider that the firm's market value is worth less than its book value.

C) Investors consider that the firm's market value and its book value are roughly equivalent.

D) Investors consider that the firm's market value is worth more than its book value.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: In 2009, an agricultural company introduced a

Q9: Use the table for the question(s) below.<br>AOS

Q21: GenCorp. has a total debt of $140

Q42: A company has a share price of

Q50: What is the main problem in using

Q59: Which of the following is the LEAST

Q80: Cash is a:<br>A)long-term asset.<br>B)current asset.<br>C)current liability.<br>D)long-term liability.

Q81: Use of Generally Accepted Accounting Principles (GAAP)

Q83: Company A has current assets of $42

Q101: U.S.public companies are required to file their