Multiple Choice

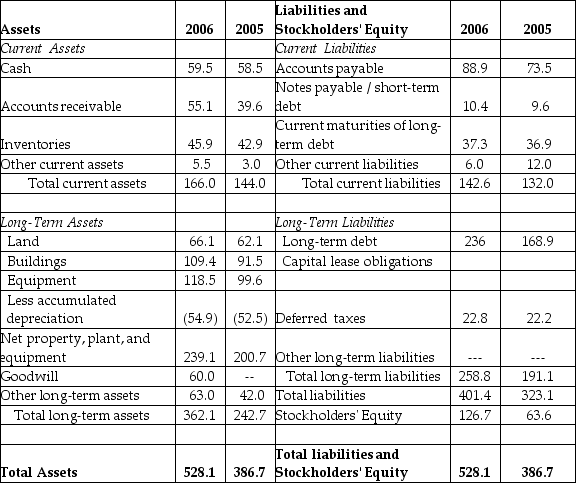

Luther Corporation

Consolidated Balance Sheet

December 31, 2006 and 2005 (in $ millions)

Refer to the balance sheet above. If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share, then Luther's market-to-book ratio would be closest to ________.

A) 2.58

B) 0.64

C) 1.29

D) 1.80

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Why must care be taken when comparing

Q3: Allen Company bought a new copy machine

Q26: A software company acquires a smaller company

Q44: The exchanges in which of the following

Q46: What are the requirements of section 404

Q75: The income statement reports the firm's revenues

Q97: Luther Corporation<br>Consolidated Income Statement<br>Year ended December 31

Q99: Luther Corporation<br>Consolidated Income Statement<br>Year ended December 31

Q100: Luther Corporation<br>Consolidated Balance Sheet<br>December 31, 2006 and

Q106: Luther Corporation<br>Consolidated Income Statement<br>Year ended December 31