Multiple Choice

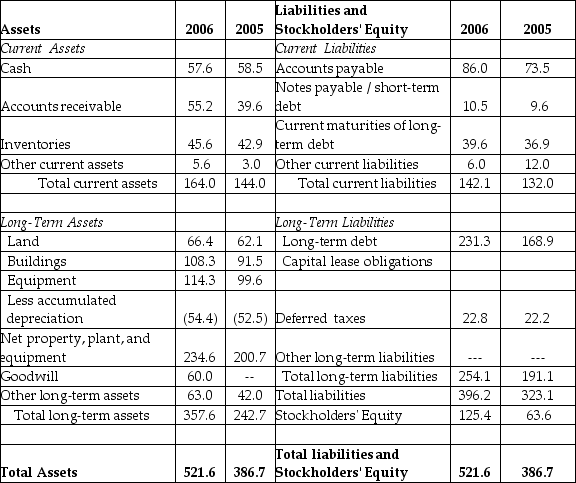

Luther Corporation

Consolidated Balance Sheet

December 31, 2006 and 2005 (in $ millions)

Refer to the balance sheet above. If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share, then using the market value of equity, the debt-equity ratio for Luther in 2006 is closest to ________.

A) 3.45

B) 1.72

C) 0.86

D) 2.41

Correct Answer:

Verified

Correct Answer:

Verified

Q16: What is a firm's net income?<br>A) the

Q22: WorldCom classified $3.85 billion in operating expenses

Q47: State the names of some of the

Q62: Which of the following firms would be

Q65: A 30-year mortgage loan is a:<br>A)long-term liability.<br>B)current

Q72: A firm whose primary business is in

Q74: Which of the following amounts would be

Q76: Which of the following is NOT a

Q79: What is the main reason that it

Q86: Use the table for the question(s) below.<br>Income