Multiple Choice

Figure 15-1

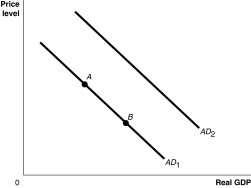

-Refer to Figure 15-1.Ceteris paribus,an increase in personal income taxes would be represented by a movement from

A) AD1 to AD2.

B) AD2 to AD1.

C) point A to point B.

D) point B to point A.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Suppose there has been an increase in

Q22: An increase in aggregate demand causes an

Q28: Figure 15-2 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4182/.jpg" alt="Figure 15-2

Q55: Figure 15-3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6608/.jpg" alt="Figure 15-3

Q73: Spending on the war in Afghanistan is

Q119: Using an aggregate demand graph,illustrate the impact

Q123: Stagflation occurs when aggregate supply and aggregate

Q142: The international trade effect states that<br>A)an increase

Q215: Starting from long-run equilibrium,use the basic aggregate

Q264: The automatic mechanism _ the price level