Multiple Choice

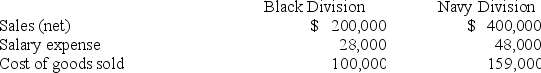

Marian Corporation has two separate divisions that operate as profit centers. The following information is available for the most recent year:  The Black Division occupies 20,000 square feet in the plant. The Navy Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute gross profit for the Black and Navy Divisions, respectively.

The Black Division occupies 20,000 square feet in the plant. The Navy Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute gross profit for the Black and Navy Divisions, respectively.

A) $72,000; $193,000.

B) $172,000; $352,000.

C) $100,000; $241,000.

D) $52,000; $163,000.

E) $72,000; $163,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Holliday, Inc., operates a retail store with

Q31: Division X makes a part with the

Q32: Karl and Grady are managers of two

Q33: Calculating return on investment for an investment

Q37: Canfield Technical School allocates administrative costs to

Q37: A company pays $15,000 per period to

Q45: Profit margin for an investment center measures:<br>A)Investment

Q52: Costs that the manager does not have

Q77: A college uses advisors who work with

Q151: Within an organizational structure,the person most likely