Multiple Choice

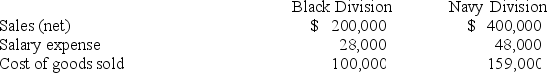

Marian Corporation has two separate divisions that operate as profit centers. The following information is available for the most recent year:  The Black Division occupies 20,000 square feet in the plant. The Navy Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute departmental income for the Black and Navy Divisions, respectively.

The Black Division occupies 20,000 square feet in the plant. The Navy Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute departmental income for the Black and Navy Divisions, respectively.

A) $52,000; $163,000.

B) $172,000; $352,000.

C) $72,000; $163,000.

D) $72,000; $193,000.

E) $100,000; $241,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q98: Match the appropriate definition a through h

Q103: Chancellor Company is divided into four departments.

Q104: A report that accumulates the actual expenses

Q114: The difference between a profit center and

Q125: Define joint costs and explain how joint

Q140: Joint costs are costs incurred in producing

Q140: What is the cash conversion cycle and

Q148: A(n) _is a department that generates revenues

Q156: Investment center managers are evaluated on their

Q178: Indirect expenses are incurred for the joint