Multiple Choice

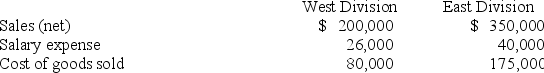

Fallow Corporation has two separate profit centers. The following information is available for the most recent year:  The West Division occupies 5,000 square feet in the plant. The East Division occupies 3,000 square feet. Rent, which was $40,000 for the year, is an indirect expense and is allocated based on square footage. Compute operating income for the West Division.

The West Division occupies 5,000 square feet in the plant. The East Division occupies 3,000 square feet. Rent, which was $40,000 for the year, is an indirect expense and is allocated based on square footage. Compute operating income for the West Division.

A) $120,000.

B) $95,000.

C) $94,000.

D) $69,000.

E) $54,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Marks Corporation has two operating departments, Drilling

Q23: Investment center managers are usually evaluated using

Q28: Direct expenses are incurred for the joint

Q35: A department that incurs costs without directly

Q37: Pleasant Hills Properties is developing a golf

Q46: Return on investment is a useful measure

Q53: Decentralization refers to companies that have multiple

Q99: Williams Co. operates three separate departments

Q115: Division P of Launch Corporation has the

Q131: An example of a controllable cost is