Multiple Choice

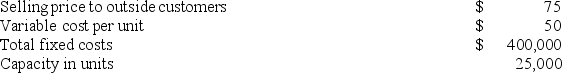

Division M makes a part that it sells to customers outside of the company. Data concerning this part appear below:  Division O of the same company would like to use the part manufactured by Division M in one of its products. Division O currently purchases a similar part made by an outside company for $70 per unit and would substitute the part made by Division M. Division O requires 5,000 units of the part each period. Division M can sell every unit it produces on the outside market. What should be the lowest acceptable transfer price?

Division O of the same company would like to use the part manufactured by Division M in one of its products. Division O currently purchases a similar part made by an outside company for $70 per unit and would substitute the part made by Division M. Division O requires 5,000 units of the part each period. Division M can sell every unit it produces on the outside market. What should be the lowest acceptable transfer price?

A) $75

B) $66

C) $16

D) $50

E) $25

Correct Answer:

Verified

Correct Answer:

Verified

Q26: A responsibility accounting performance report displays:<br>A)Only actual

Q36: Investment center is another name for profit

Q54: A responsibility accounting performance report usually compares

Q93: Direct expenses require allocation across departments because

Q102: How do companies decide what allocation bases

Q114: A company produces two joint products (called

Q137: Differential Chemical produced 10,000 gallons of Preon

Q161: A system of performance measures, including nonfinancial

Q165: Direct expenses are costs readily traced to

Q177: A _ incurs costs without directly generating