Multiple Choice

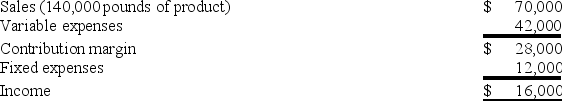

The Mixed Nuts Division of Yummy Snacks, Inc. had the following operating results last year:

Yummy expects identical operating results in the division this year. The Mixed Nuts Division has the ability to produce and sell 200,000 pounds of product annually. Assume that the Trail Mix Division of Yummy wants to purchase an additional 20,000 pounds of nuts from the Mixed Nuts Division. Mixed Nuts will be able to increase its profit by accepting any transfer price above:

A) $0.25 per pound

B) $0.08 per pound

C) $0.15 per pound

D) $0.30 per pound

E) $0.10 per pound

Correct Answer:

Verified

Correct Answer:

Verified

Q19: The salaries of employees who spend all

Q20: In a firm that manufactures clothing,the department

Q62: The _ is a report of the

Q86: Joint costs can be allocated either using

Q89: Indirect expenses are allocated to departments based

Q101: The most useful allocation basis for the

Q135: Sturdivant Fasteners, Co. uses a traditional allocation

Q136: What is the purpose of a responsibility

Q142: Marks Corporation has two operating departments,

Q153: Costs that the manager has the power