Essay

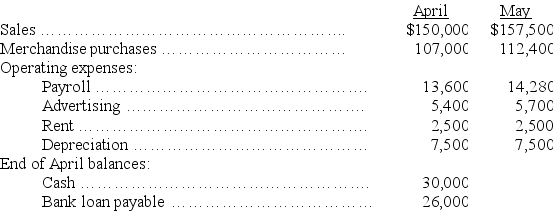

Todd Enterprises is preparing a cash budget for the second quarter of the coming year. The following data have been forecasted:

Additional data:

Additional data:

(1) Sales are 40% cash and 60% credit. The collection pattern for credit sales is 50% in the month following the sale and 50% in the month thereafter. Total sales in March were $125,000.

(2) Purchases are all on credit, with 40% paid in the month of purchase and 60% paid in the following month.

(3) Operating expenses are paid in the month they are incurred.

(4) A minimum cash balance of $25,000 is required at the end of each month.

(5) Loans are used to maintain the minimum cash balance. At the end of each month, interest of 1% per month is paid on the outstanding loan balance as of the beginning of the month. Repayments are made at the end of the month if the cash balance exceeds $25,000.

Prepare the company's cash budget for May. Show the ending loan balance at May 31.

Correct Answer:

Verified

Correct Answer:

Verified

Q30: A cash budget shows the expected cash

Q49: Part of the budgeting process is summarizing

Q73: Memphis Company anticipates total sales for April,May,and

Q97: Trago Company manufactures a single product and

Q113: Flagstaff Company has budgeted July production of

Q115: A managerial accounting report that presents predicted

Q185: The sales budget is derived from the

Q201: Bengal Co. provides the following unit sales

Q206: Ruiz Co. provides the following unit sales

Q208: Lafayette Company's experience shows that 20% of