Multiple Choice

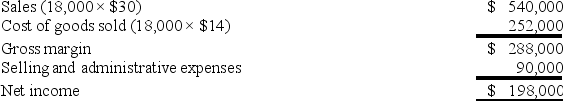

Tim's Tools, a manufacturer of cordless drills, began operations this year. During this year, the company produced 20,000 units and sold 18,000 units. At year-end, the company reported the following income statement using absorption costing:  Production costs per unit total $14, which consists of $12.90 in variable production costs and $1.10 in fixed production costs (based on the 20,000 units produced) . 60% of total selling and administrative expenses are variable. Compute net income under variable costing.

Production costs per unit total $14, which consists of $12.90 in variable production costs and $1.10 in fixed production costs (based on the 20,000 units produced) . 60% of total selling and administrative expenses are variable. Compute net income under variable costing.

A) $307,800

B) $198,000

C) $195,800

D) $288,000

E) $220,000

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Which of the following statements is true

Q96: Given Advanced Company's data,compute cost of finished

Q114: Variable costing separates variable costs from fixed

Q157: Which of the following is not a

Q160: To convert variable costing net income to

Q163: Given the following data, calculate the total

Q166: Urban Company reports the following information regarding

Q167: Aces, Inc., a manufacturer of tennis rackets,

Q169: Triton Industries reports the following information

Q172: A company reports the following information for