Multiple Choice

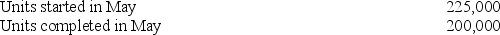

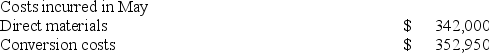

Pitt Enterprises manufactures jeans. All materials are introduced at the beginning of the manufacturing process in the Cutting Department. Conversion costs are incurred uniformly throughout the manufacturing process. As the cutting of material is completed, the pieces are immediately transferred to the Sewing Department. Information for the Cutting Department for the month of May follows. Work in Process, May 1 (50,000 units, 100% complete for direct materials, 40% complete with respect to conversion costs; includes $70,500 of direct material cost; $34,050 of conversion costs) . Work in Process, May 31 (75,000 units, 100% complete for direct materials; 20% complete for conversion costs) .

Work in Process, May 31 (75,000 units, 100% complete for direct materials; 20% complete for conversion costs) . If Pitt Enterprises uses the FIFO method of process costing, compute the cost per equivalent unit for direct materials and conversion costs respectively for May.

If Pitt Enterprises uses the FIFO method of process costing, compute the cost per equivalent unit for direct materials and conversion costs respectively for May.

A) $1.52; $1.81.

B) $1.50; $1.76.

C) $1.83; $1.72.

D) $1.71; $1.81.

E) $3.30; $3.30.

Correct Answer:

Verified

Correct Answer:

Verified

Q80: The following data is available for Donaldson

Q82: Metaline Corp. uses the weighted average method

Q84: Refer to the following information about the

Q89: Describe the flow of overhead costs in

Q109: Luker Corporation uses a process costing system.The

Q150: The FIFO method of computing equivalent units

Q166: A company uses a process costing system.Its

Q183: The number of equivalent units of production

Q195: Process operations, also called process manufacturing or

Q207: Richards Corporation uses the FIFO method of