Essay

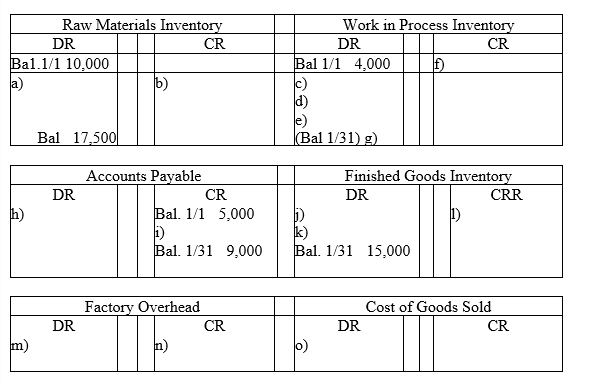

MOB Corp. applies overhead on the basis of direct labor costs. Its bookkeeper accidentally deleted most of the journal entries that had been recorded for January. A printout of the general ledger (in T-account form) showed the following:

A review of the prior year's financial statements, the current year's budget, and January's source documents produced the following information:

(1) Accounts Payable is used for raw material purchases only. January purchases were $49,000.

(2) Factory overhead costs for January were $17,000 none of which is indirect materials.

(3) The January 1 balance for finished goods inventory was $10,000.

(4) There was a single job in process at January 31 with a cost of $2,000 for direct materials and $1,500 for direct labor.

(5) Total cost of goods manufactured for January was $90,000.

(6) All direct laborers earn the same rate ($13/hour). During January, 2,500 direct labor hours were worked.

(7) The predetermined overhead rate is based on direct labor costs. Budgeted (expected) overhead for the year is $195,000 and budgeted (expected) direct labor is $390,000.

Fill in the missing amounts a) through o) above in the T-accounts above.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Overapplied overhead is the amount by which

Q61: A company's predetermined overhead rate is applied

Q92: If overhead is overapplied, it means that

Q113: At year-end,Marshall Enterprise's Factory Overhead account has

Q124: A company's overhead rate is 200% of

Q137: If overhead is underapplied, it means that

Q138: Job cost sheets include both product and

Q143: The rate established at the beginning of

Q156: A job order costing system would best

Q203: Clemmens Company applies overhead based on direct