Essay

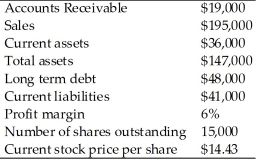

The following information is available for the Oil Creek Corporation.

(a) What is the current ratio?

(b) What is the net working capital?

(c) What is the net income?

(d) What is the return on equity?

(e) What is the total asset turnover?

(f) What is the debt-equity ratio?

(g) What is the accounts receivable turnover?

(h) What is the earnings per share (EPS)?

(i) What is the price to earnings (P/E) ratio?

Correct Answer:

Verified

(a) 0.88

(b) -$5,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(b) -$5,000...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Generally, the market price of a stock

Q16: If a firm has an ROA of

Q34: Price-to-book-value indicates how aggressively a stock is

Q35: For most companies, the dividend payout ratio

Q37: Rising corporate profits and are likely to

Q41: Which measure of the business cycle represents

Q60: Which one of the following is a

Q93: A company has a net loss for

Q110: List and explain the various stages of

Q128: Which of the following measures excludes non-cash