Essay

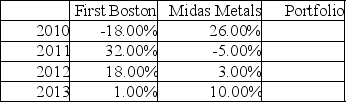

Returns on the stock of First Boston and Midas Metals for the years 2010-2013 are shown below.

a. Compute the average annual return for each stock and a portfolio consisting of 50% First Boston and 50% Midas.

b. Compute the standard deviation for each stock and the portfolio.

c. Are the stocks positively or negatively correlated and what is the effect on risk?

Correct Answer:

Verified

c. The two stocks are negatively correl...

c. The two stocks are negatively correl...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Portfolios falling to the left of the

Q55: Correlation is a measure of the relationship

Q65: Investing in emerging markets is an effective

Q90: The Franko Company has a beta of

Q91: Amanda has the following portfolio of assets.

Q94: Which of the following will lower a

Q96: Estimates of a stock's beta may vary

Q97: Which of the following best describes the

Q101: When the stock market has bottomed out

Q110: The efficient frontier<br>A) is represented by the