Multiple Choice

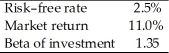

You have gathered the following information concerning a particular investment and conditions in the market.  According to the Capital Asset Pricing Model, the required return for this investment is

According to the Capital Asset Pricing Model, the required return for this investment is

A) 8.85%.

B) 11.48%.

C) 13.98%.

D) 14.85%.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Portfolios located on the efficient frontier are

Q29: Systematic risks<br>A)can be eliminated by investing in

Q34: Negatively correlated assets reduce risk more than

Q41: The betas of most stocks are constant

Q50: Coefficients of correlation range from a maximum

Q64: What is the expected return on a

Q72: In the real world, most of the

Q87: By plotting the efficient frontier, investors can

Q90: Standard deviation is a measure that indicates

Q91: Which of the following represent systematic risks?<br>I.