Essay

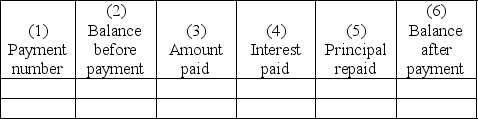

FIGURE 8.1 Basic Design of a Loan Repayment Schedule

Use the design shown in Figure 8.1 to construct a complete repayment schedule including the totaling of the Amount Paid, Interest Paid, and Principal Repaid columns for the following loan.

Use the design shown in Figure 8.1 to construct a complete repayment schedule including the totaling of the Amount Paid, Interest Paid, and Principal Repaid columns for the following loan.

On April 22, Tim borrowed $2900.00 from Keewatin Credit Union at 6.5% per annum calculated on the daily balance. He gave the Credit Union four cheques for $535.00 dated the 15th of each of the next four months starting May 15 and a cheque dated October 15 for the remaining balance to cover payment of interest and repayment of principal.

Correct Answer:

Verified

Repayment ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q52: Calculate the maturity value of a 180-day

Q53: A 60-day non-interest-bearing promissory note for $10

Q54: You borrowed the amount indicated in the

Q55: Calculate the legal due date of a

Q56: A promissory note has a face value

Q58: A promissory note has a face value

Q59: The East Lake Karate Club arranged short-term

Q60: Sean borrowed $3000.00 from Sepaba Savings and

Q61: Marty took a $5000 loan from a

Q62: A promissory note has a face value