Essay

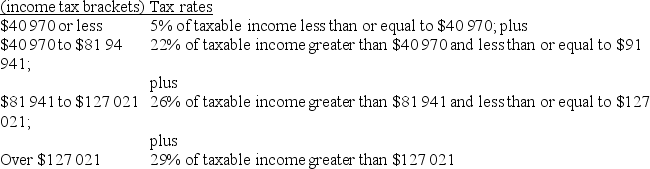

Use the 2010 federal income tax brackets and rates listed below to answer the following question.

Taxable Income

a) Dana had a taxable income of $39 500 in 2010. How much federal income tax should she report? (assuming tax rates remain the same)

a) Dana had a taxable income of $39 500 in 2010. How much federal income tax should she report? (assuming tax rates remain the same)

b) Dana expects her taxable income to increase by 15% in 2011. How much federal tax would she expect to pay in 2011(assuming tax rates remain the same).

Correct Answer:

Verified

a) Federal tax on $3...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q52: Justin took out 41% of all the

Q53: After spending a week in the United

Q54: The amount of $2250 is what percent

Q55: Solve: 2.18 : 1.61 = k :

Q56: Use proportions to solve the problem: Angela

Q58: $170 is what percent of $80?

Q59: A private post-secondary corporation had a 1-year

Q60: ABC Charity is distributing charity among the

Q61: Use Table 3.2 on page 120 of

Q62: $36 is what percent of $14?