Essay

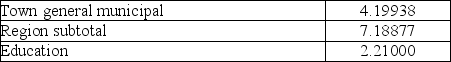

Paul is a homeowner in Whitby and his home value has been recently assessed by MPAC as $339 500. Paul's tax notice lists the following mill rates for various local services and capital developments. Calculate current year's total property tax.

Correct Answer:

Verified

Total property tax rate = 4.19...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Reduce the following fraction to the lowest

Q14: Simplify, then round to the nearest hundredth:

Q15: In 2011, Danny invested his savings among

Q16: Purchases of an inventory item during last

Q17: Nick's gross earnings for one week was

Q19: A salesperson had gross earnings of $943.25

Q20: Convert this fraction into the decimal form.

Q21: Barb's Home Income Tax business operates only

Q22: A.J. is paid an annual salary of

Q23: Change 0.035 into a percent.