Multiple Choice

From the table above we can conclude

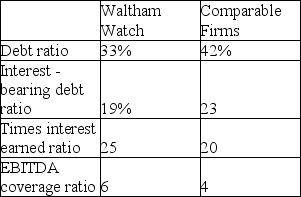

From the table above we can conclude

A) Waltham has a conservative capital structure policies.

B) Waltham has too much debt.

C) Waltham uses more leverage than the typical firm in its industry.

D) Waltham's EPS would be more sensitive than a typical firm's to changes in EBIT.

Correct Answer:

Verified

Correct Answer:

Verified

Q48: Investors require a higher return on common

Q49: The tradeoff theory of capital structure management

Q50: A company that earns a rate of

Q51: What is meant by the terms "favorable"

Q52: Newbury Inc. has retained $2 million in

Q54: Lowell Corporation and Lawrence Corporation each have

Q55: List and briefly explain at least two

Q56: The indifference level of EBIT is<br>A) $99,000.<br>B)

Q57: Why is the Debt to Assets Ratio

Q58: Boylston Inc.'s total interest bearing debt is