Essay

Fully amortizing installment note payable (mortgage)

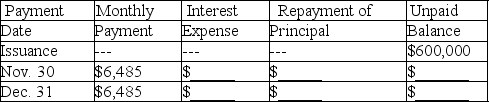

On October 31,2018,Seldon Company incurs a 30-year $600,000 mortgage liability in conjunction with the purchase of a motel.This mortgage is payable in equal monthly installments of $6,485,which include interest computed at an annual rate of 12%.The first monthly payment is made on November 30,2018.This mortgage is fully amortizing over 360 months.

Complete the amortization table for the first two payments by entering the correct dollar amounts in the blank spaces provided.In addition,answer the questions that follow.

(a)With respect to this mortgage,Seldon's 2018 income statement includes interest expense of $________,and Seldon's balance sheet at December 31,2018 includes a total liability for this mortgage of $________.(Do not separate into current and long-term portions. )

(a)With respect to this mortgage,Seldon's 2018 income statement includes interest expense of $________,and Seldon's balance sheet at December 31,2018 includes a total liability for this mortgage of $________.(Do not separate into current and long-term portions. )

(b)The aggregate monthly cash payments Seldon will make over the 30-year life of the mortgage amount to $________.

(c)Over the 30-year life of the mortgage,the amount Seldon will pay for interest amounts to $________.

Correct Answer:

Verified

1 $600,000 × 0.12 × 1 ÷ 12 = 6,000 2.$6...

1 $600,000 × 0.12 × 1 ÷ 12 = 6,000 2.$6...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: When a company sells bonds,the bondholders are

Q42: A commitment,such as a contract to pay

Q43: When bonds are sold by one investor

Q44: Estimated liabilities,contingencies,and commitments are usually reported in

Q45: A company issues $50 million of bonds

Q47: Which of the following payroll costs are

Q48: [The following information applies to the questions

Q49: The amortization of discount on bonds payable

Q50: Loss contingencies should be recorded in the

Q51: Worker's compensation premiums are deducted from each