Essay

Fully amortizing installment note payable

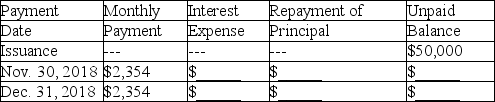

On October 31,2018 Ronald signed a 2-year installment note in the amount of $50,000 in conjunction with the purchase of equipment.This note is payable in equal monthly installments of $2,354,which include interest computed at an annual rate of 12%.The first monthly payment is made on November 30,2018.This note is fully amortizing over 24 months.

Complete the amortization table for the first two payments by entering the correct dollar amounts in the blank spaces provided.In addition,answer the questions that follow.

(a)With respect to this note,Ronald's 2018 income statement includes interest expense of $________,and Ronald's balance sheet at December 31,2018,includes a total liability for this note payable of ________.(Do not separate into current and long-term portions. )

(a)With respect to this note,Ronald's 2018 income statement includes interest expense of $________,and Ronald's balance sheet at December 31,2018,includes a total liability for this note payable of ________.(Do not separate into current and long-term portions. )

(b)The aggregate monthly cash payments Ronald will make over the 2-year life of the note payable amount to $________.

(c)Over the 2-year life of the note,the amount Ronald will pay for interest amounts to $________.

Correct Answer:

Verified

(a)With respect to this note,Ronald's 2...

(a)With respect to this note,Ronald's 2...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q65: Since payment is due within one year,the

Q66: With respect to this bond issue,Cricket Corporation's

Q67: With respect to this bond issue,Greenway's balance

Q68: The underwriter guarantees the issuing corporation a

Q69: Which one of the following would cause

Q71: Which of the following is not a

Q72: The amount of FICA tax and Medicare

Q73: [The following information applies to the questions

Q74: A pension fund is an independent entity

Q75: [The following information applies to the questions