Essay

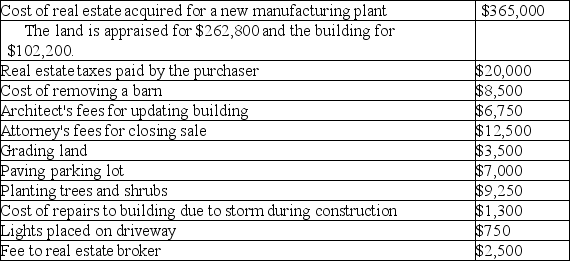

The following expenditures are related to land,land improvements,and buildings,which were acquired on November 1,2018.

Required:

Required:

Determine the cost of the land,the building and the improvements (Round to the nearest dollar)

Prepare journal entries on December 31,2018 for depreciation assuming the building will have a useful life of 20 years and no residual value.Use double declining balance method and the half-year convention.Depreciate the land improvements using straight-line method,a 5-year life,to the nearest month with zero residual value (to the nearest dollar).

Correct Answer:

Verified

The cost of the land is $309,800 ($262,8...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q111: [The following information applies to the questions

Q112: Land and a warehouse were acquired for

Q113: Wilbur Company purchased $10,000 of equipment on

Q114: The write-down of an impaired asset is

Q115: Assets are shown in the balance sheet

Q117: Prepare journal entries for the following:<br> <img

Q118: [The following information applies to the questions

Q119: Sum-of-the-years' digits is a decelerated method of

Q120: For financial reporting purposes,the gain or loss

Q121: Which of the following statements about MACRS