Essay

Recording transactions in T accounts;trial balance

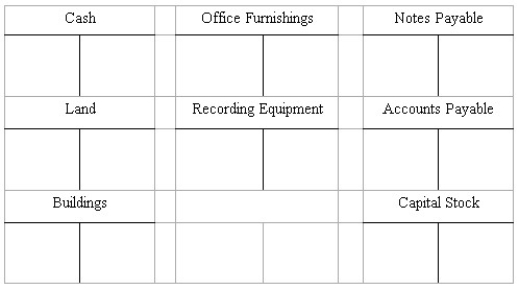

On May 15,George Manny began a new business,called Sounds,Inc. ,a recording studio to be rented out to artists on an hourly or daily basis.The following six transactions were completed by the business during May:

(a. )Issued to Manny 5,000 shares of capital stock in exchange for his investment of $200,000 cash.

(b. )Purchased land and a building for $410,000,paying $100,000 cash and signing a note payable for the balance.The land was considered to be worth $310,000 and the building $100,000.

(c. )Installed special insulation and soundproofing throughout most of the building at a cost of $120,000.Paid $32,000 cash and agreed to pay the balance in 60 days.Manny considers these items to be additional costs of the building.

(d. )Purchased office furnishings costing $18,000 and recording equipment costing $88,400 from Music Supplies.Sounds paid $28,000 cash with the balance due in 30 days.

(e. )Borrowed $180,000 from a bank by signing a note payable.

(f. )Paid the full amount of the liability to Music Supplies arising from the purchases in D above.

Instructions

(A. )Record the above transactions directly in the T accounts below.Identify each entry in a T account with the letter shown for the transaction.This exercise does not call for the use of a journal.  (B. )Prepare a trial balance at May 31 by completing the form provided.

(B. )Prepare a trial balance at May 31 by completing the form provided.

SOUNDS,INC.

Trial Balance

May 31,20__

Debit Credit

Correct Answer:

Verified

Correct Answer:

Verified

Q12: [The following information applies to the questions

Q13: The reason that revenue is recorded by

Q14: [The following information applies to the questions

Q15: The credit side of an account is

Q16: A journal entry to recognize an expense

Q18: [The following information applies to the questions

Q19: The accrual basis of accounting recognizes expenses

Q20: 200 On June 18,Baltic Arena paid $6,600

Q21: Recording transactions journal entry grid<br>A list of

Q22: A credit to a ledger account refers