Essay

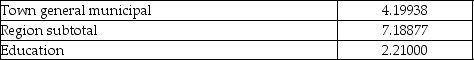

Paul is a homeowner in Whitby and his home value has been recently assessed by MPAC as $339 500.Paul's tax notice lists the following mill rates for various local services and capital developments.Calculate current year's total property tax.

Correct Answer:

Verified

Total property tax rate = 4.19...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Nick's gross earnings for one week was

Q47: Corrine Davis had gross earnings of $937.50

Q56: A salesperson is paid a weekly salary

Q59: Esther's flower shop had sales revenue of

Q77: Isabelle works for The Brick, a furniture

Q78: Three mechanics worked 15 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4211/.jpg" alt="Three

Q83: Purchases of an inventory item during last

Q87: Sean's residence is assessed by the local

Q89: Scott Rae had gross earnings of $554.30

Q126: Simplify: 3 + 8 ∗ 4