Multiple Choice

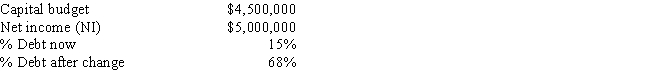

Clark Farms Inc.has the following data,and it follows the residual dividend model.Currently,it finances with 15% debt.Some Clark family members would like for the dividends to be increased.If Clark increased its debt ratio,which the firm's treasurer thinks is feasible,by how much could the dividend be increased,holding other things constant?

A) $2,957,400

B) $2,718,900

C) $1,860,300

D) $2,385,000

E) $1,955,700

Correct Answer:

Verified

Correct Answer:

Verified

Q2: If a firm uses the residual dividend

Q7: Myron Gordon and John Lintner believe that

Q20: Which of the following statements about dividend

Q29: One implication of the bird-in-the-hand theory of

Q29: Which of the following statements is CORRECT?<br>A)

Q36: Which of the following statements is NOT

Q47: New Orleans Builders Inc.has the following data.If

Q48: Whitman Antique Cars Inc.has the following data,and

Q54: If a firm declares a 20:1 stock

Q59: Which of the following statements is CORRECT?<br>A)