Multiple Choice

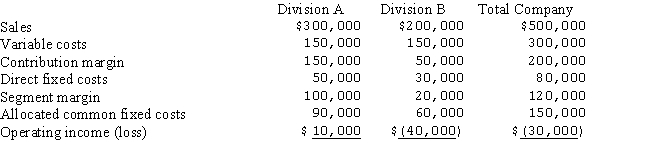

Consider the Marshall Company's segment analysis:  Common costs are allocated based on sales dollars.If Marshall eliminates Segment B,what is the impact on the operating loss of the company?

Common costs are allocated based on sales dollars.If Marshall eliminates Segment B,what is the impact on the operating loss of the company?

A) The loss decreases by $40,000.

B) The loss increases by $20,000.

C) The loss decreases by $60,000.

D) The loss increases by $40,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Hoctor Industries wishes to determine the profitability

Q20: Fortran Industries produces burner elements for stoves.Each

Q21: Income taxes<br>A)will increase the break-even point.<br>B)will decrease

Q22: Another term for cost incurred to sell

Q23: Johns Company operates in three different industries

Q25: Consider the following information about the Gumm

Q26: Which of the following is true about

Q27: A traditional break-even chart is illustrated below:

Q28: The Blue Saints Band is holding a

Q29: Calico Corporation makes the following products: <img