Essay

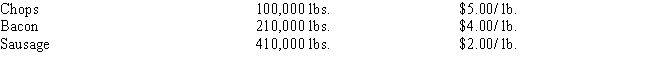

Jim Davis Company processes hogs into three products,chops,bacon and sausage.Production and selling price data follow:  Hogs are processed in the Processing Department.From the split-off point,bacon is smoked,sliced and packaged in the Bacon Department.The cost incurred for these processes was $100,000.In addition,sausage was ground and formed into patties in the Sausage Department after the split-off.This process cost $60,000.

Hogs are processed in the Processing Department.From the split-off point,bacon is smoked,sliced and packaged in the Bacon Department.The cost incurred for these processes was $100,000.In addition,sausage was ground and formed into patties in the Sausage Department after the split-off.This process cost $60,000.

Required:

a)If joint processing costs were $1,500,000,calculate the total cost of each product using the adjusted sales value method.

b)Prepare the journal entries to 1)record the joint processing and movement of product out of the Processing Department after the split off,and 2)record the additional processing and completion of the bacon and sausage.

Correct Answer:

Verified

a.  Total cost:

Total cost:

Chops $375,000

Bacon $55...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Chops $375,000

Bacon $55...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: In a process cost system,the cost attributable

Q49: Regina Manufacturing uses the FIFO method of

Q50: If two or more products share a

Q51: Terrell Corporation manufactures Products X,Y,and Z from

Q52: Which of the following statements best describes

Q53: If a company using the adjusted sales

Q54: Van Pelt Company uses the average cost

Q55: When two products are produced during a

Q56: Normal losses that occur in the manufacturing

Q58: Stanley Company adds materials at the beginning