Multiple Choice

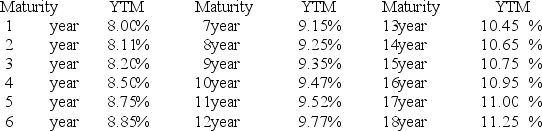

YIELD CURVE FOR ZERO COUPON BONDS RATED AA

Assume that there are no liquidity premiums.

To the nearest basis point,what is the expected interest rate on a four-year maturity AA zero coupon bond purchased six years from today?

A) 10.41 percent

B) 10.05 percent

C) 9.16 percent

D) 10.56 percent

E) 9.96 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q37: Classify each of the following in terms

Q38: Inflation causes the demand curve for loanable

Q39: The unbiased expectations hypothesis of the term

Q40: An increase in the marginal tax rates

Q41: Investment A pays 8 percent simple interest

Q43: You buy a car for $38,000. You

Q44: According to the market segmentation theory,short-term investors

Q45: An increase in interest rates increases the

Q46: As the liquidity of corporate bonds decrease,the

Q47: Can the actual real rate of interest