Multiple Choice

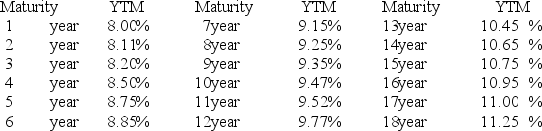

YIELD CURVE FOR ZERO COUPON BONDS RATED AA

Assume that there are no liquidity premiums.

You just bought a 15-year maturity Xerox corporate bond rated AA with a 0 percent coupon. You expect to sell the bond in eight years. Find the expected interest rate at the time of sale (watch out for rounding error) .

A) 13.92 percent

B) 11.00 percent

C) 8.85 percent

D) 12.49 percent

E) 12.80 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Suppose you borrow $15,000 and then repay

Q13: Explain the logic of the liquidity premium

Q14: You want to have $5 million when

Q15: An investor wants to be able to

Q16: In October 1987 stock prices fell 22

Q18: The term structure of interest rates is

Q19: Upon graduating from college this year,you expect

Q20: A higher level of wealth causes the

Q21: The one-year spot rate is currently 4

Q22: The traditional liquidity premium theory states that