Multiple Choice

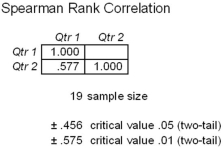

Returns on an investor's stock portfolio (n = 19 stocks) are compared for the same stock in each of two consecutive quarters.Since the returns are not normally distributed (normality test p-values were .005 and .126 respectively) ,a nonparametric test was chosen.The test results are shown below.  Which is the best conclusion?

Which is the best conclusion?

A) The returns are correlated neither at α = .05 nor at α = .01.

B) The returns are correlated at α = .05 but not at α = .01.

C) The returns are correlated at α = .01 but not at α = .05.

D) The returns are correlated both at α = .05 and at α = .01.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: The Mann-Whitney test is analogous to a

Q14: Nonparametric tests can often be used in

Q15: The Spearman rank correlation test compares medians

Q17: Systolic blood pressure of randomly selected HMO

Q19: Most nonparametric tests assume ordinal data.

Q23: The Wilcoxon signed-rank test is an alternative

Q42: Which is not a characteristic of the

Q48: The one-sample runs test is useful to

Q68: Nonparametric tests generally are more powerful than

Q79: The one-sample runs test is similar to