Essay

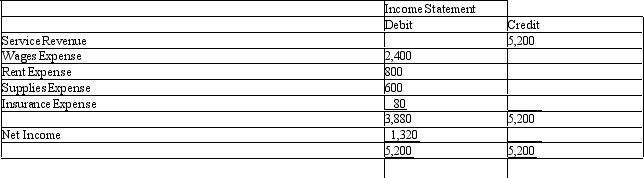

Prepare closing entries for December (omit explanations)from the following Income Statement columns of the work sheet of Kemp Corporation,assuming that a $1,000 withdrawal was made during the period.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Which of the following accounts might appear

Q40: The owner's Capital,Withdrawals,and Income Summary accounts for

Q57: Discuss reversing entries by addressing each of

Q63: During the closing process,revenues are transferred to

Q69: Despite the many uses of laptop computers,they

Q102: A reversing entry will include either a

Q107: An adjusted trial balance provides all the

Q112: Closing entries deal primarily with the balances

Q126: Briefly distinguish between adjusting and closing entries.

Q170: Preparing the work sheet and closing entries<br>A)saves