Essay

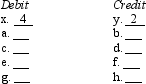

Use the numbers corresponding to the accounts below to indicate the entries for the transactions below.You may debit or credit more than one account.Dollar amounts have been omitted.The first one (x-y)has been done for you.

1.Accounts Receivable

2.Owner's Capital

3.Withdrawals

4.Cash

5.Income Summary

6.Legal Fees Earned

7.Rent Expense

8.Salaries Expense

9.Salaries Payable

10.Unearned Legal Fees

x-y.To record cash invested by the owner

a-b.To record the reversal of the entry that adjusted for accrued legal fees

c-d.To close the Income Summary account when net income has been realized

e-f.To record the closing of expense account(s)

g-h.To record payment of salaries for which an adjusting entry was made a few days before.The appropriate reversing entry also was made.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Preparing the work sheet<br>A)is done rather than

Q43: What two broad purposes do closing entries

Q84: When a work sheet is prepared<br>A)closing entries

Q86: An amount would not appear opposite the

Q111: The Adjusted Trial Balance columns of the

Q118: The Income Statement columns of the work

Q128: All of the following items are associated

Q133: What does the preparation of reversing entries

Q146: Which of the following accounts is not

Q154: The owner's Capital,Withdrawals,and Income Summary accounts for