Essay

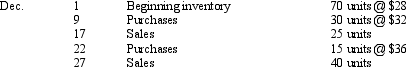

Use the following information to calculate ending inventory on (a)a LIFO basis,(b)a FIFO basis,and (c)an average-cost basis.Assume a perpetual inventory system.

Correct Answer:

Verified

a. LIFO: 50 × $28 = $1,400.00 b. FIFO: (...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

a. LIFO: 50 × $28 = $1,400.00 b. FIFO: (...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q16: Which inventory method generally best follows the

Q21: Valuation of inventory on the balance sheet

Q37: The specific identification method is well suited

Q66: A jeweler probably would use which of

Q67: Which costing method will produce the same

Q98: The LIFO method tends to create peaks

Q103: In a period of declining prices,which of

Q139: An overstatement of ending inventory in a

Q143: Use this inventory information for the month

Q158: Inventory is an example of a long-term