Multiple Choice

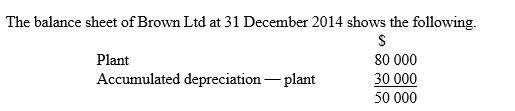

On 1 January 2015, based on a valuer's estimate of fair value, it was decided to revalue the plant to $65 000. The plant was then assessed to have a further useful life of 5 years and an expected residual amount of $5000. What is the journal entry in the books of Brown Ltd to record depreciation on plant on a straight-line basis for the half-year ending 30 June 2015 (balance date) ?

On 1 January 2015, based on a valuer's estimate of fair value, it was decided to revalue the plant to $65 000. The plant was then assessed to have a further useful life of 5 years and an expected residual amount of $5000. What is the journal entry in the books of Brown Ltd to record depreciation on plant on a straight-line basis for the half-year ending 30 June 2015 (balance date) ?

A) Depreciation expense - plant 12 000 Accumulated depreciation- plant 12 000

B) Depreciation expense - plant 6 000 Accumulated depreciation - plant 6 000

C) Accumulated depreciation - plant 6 000 Depreciation expense - plant 6 000

D) Depreciation expense - plant 6 500 Accumulated depreciation- plant 6 500

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Which statement concerning patents is true?<br>A) A

Q33: Under IAS 38/AASB 138, which statement concerning

Q34: Under the accounting standard dealing with revaluations,

Q35: Carrying amount of equipment is what type

Q36: Which statement about goodwill is true?<br>A) Goodwill

Q38: On 31 December 2013 a printing machine

Q39: Under IAS 41/AASB 141 the basis for

Q40: How many of these are requirements of

Q41: Which statement concerning revaluations that reverse prior

Q42: King Ltd acquired the business of Prince