Multiple Choice

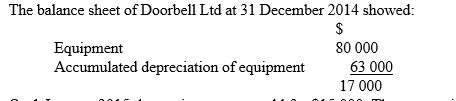

On 1 January 2015 the equipment was sold for $15 000. The accounting entry to record the closing of the equipment and the accumulated depreciation of equipment accounts is which of the following?

On 1 January 2015 the equipment was sold for $15 000. The accounting entry to record the closing of the equipment and the accumulated depreciation of equipment accounts is which of the following?

A) Debit accumulated depreciation equipment $63 000; credit equipment $63 000

B) Debit accumulated depreciation equipment $63 000; debit carrying amount of equipment $17 000; credit equipment $80 000

C) Debit bank $15 000; credit carrying amount of equipment $15 000

D) Debit accumulated depreciation equipment $17 000; credit equipment $17 000

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Which is the true statement?<br>A) A revaluation

Q26: Which statement relating to the composite-rate depreciation

Q27: FK Ltd's fleet of delivery trucks (original

Q28: Which of these are not examples of

Q29: On 31 December 2014 an aeroplane with

Q31: When a non-current asset is sold the

Q32: Which statement concerning patents is true?<br>A) A

Q33: Under IAS 38/AASB 138, which statement concerning

Q34: Under the accounting standard dealing with revaluations,

Q35: Carrying amount of equipment is what type