Multiple Choice

Machinery is purchased on credit for $16 000 plus GST. The general journal entry to record this transaction is which of the following?

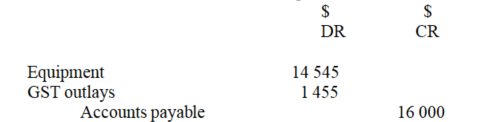

A)

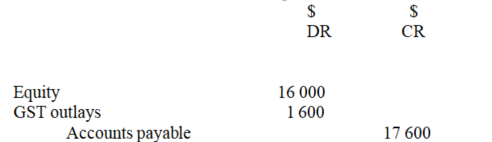

B)

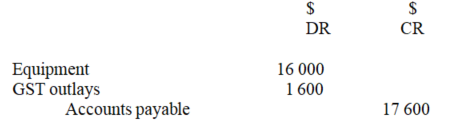

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q51: A deposit received in advance by Adelaide

Q52: If a sole proprietor who owns an

Q53: A credit entry is made to:<br>A) decrease

Q54: The true statement concerning the accounting period

Q55: Which of these events would be recorded

Q57: J. Wood performed carpentry services for $7500.

Q58: Balance sheet accounts are of three basic

Q59: In order to provide timely information for

Q60: The source document for a cash sale

Q61: A chart of accounts is a:<br>A) planning