Multiple Choice

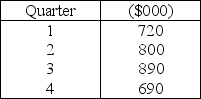

Musk L.Flexor owns a hot tub store that is experiencing significant growth.Flexor is trying to decide whether to expand its capacity,which currently is at $750,000 in sales per quarter.He is thinking about expanding to the $850,000 level.The before-tax profit from additional sales is 20 percent.Sales are seasonal,with peaks in the spring and summer quarters.Forecasts of capacity requirements,expressed in sales per quarter,for next year (year 2) are:  Demand in year 3 and beyond is expected to exceed $850,000 per quarter.Flexor is considering expansion at the end of the fourth quarter of this year (year 1) .How much would before-tax profits in year 2 increase because of this expansion?

Demand in year 3 and beyond is expected to exceed $850,000 per quarter.Flexor is considering expansion at the end of the fourth quarter of this year (year 1) .How much would before-tax profits in year 2 increase because of this expansion?

A) less than $28,000

B) more than $28,000 but less than $32,000

C) more than $32,000 but less than $36,000

D) more than $36,000

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Which one of the following statements about

Q24: Decision trees can be useful for evaluation

Q45: Increasing the overall process capacity can only

Q47: The expansionist strategy refers to a condition

Q59: Generally, work- in- process inventory will be

Q62: Utilization is calculated as the ratio of

Q68: Setup time is the time required to

Q75: Which one of the following statements about

Q82: Which one of the following statements about

Q142: The total time that a typical item