Multiple Choice

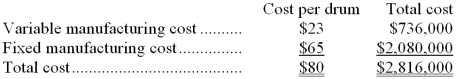

Rowena Corporation manufactures laser printers. Rowena currently manufactures the 32,000 imaging drums that it uses in its printers. The annual costs to manufacture these 32,000 drums are as follows:  Hardware Solutions, Inc. has offered to provide Rowena with all of its imaging drum needs for $72 per drum. If Rowena accepts this offer, 70% of the fixed manufacturing cost above could be totally eliminated. Also, Rowena will be able to use the freed up space to generate $240,000 of income each year in the production of alternative products.

Hardware Solutions, Inc. has offered to provide Rowena with all of its imaging drum needs for $72 per drum. If Rowena accepts this offer, 70% of the fixed manufacturing cost above could be totally eliminated. Also, Rowena will be able to use the freed up space to generate $240,000 of income each year in the production of alternative products.

-Assume that demand for Rowena printers goes up from 32,000 annually to 40,000 annually. Also assume that Rowena has the idle capacity to produce the extra 8,000 drums needed for the printers. Under these conditions, would Rowena be better off to make the drums or buy the drums and by how much? (Assume that there is no change in cost structure.)

A) $96,000 better to buy

B) $160,000 better to buy

C) $204,000 better to make

D) $264,000 better to make

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Hayase Corporation processes sugar beets that it

Q48: The constraint at Crumedy Inc. is an

Q49: All future costs are relevant in decision

Q50: All other things equal, it is profitable

Q51: Lounsberry Inc. regularly uses material O55P and

Q53: Two products, TD and IB, emerge from

Q55: Govoni Corporation is a specialty component manufacturer

Q56: Isaac Corporation processes sugar beets in batches

Q57: Part J88 is used in one of

Q116: Mae Refiners, Inc., processes sugar cane that