Multiple Choice

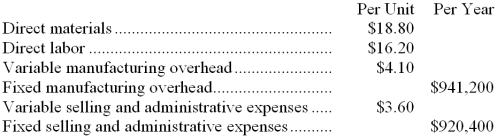

Diehl Company makes a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 52,000 units per year.

The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 52,000 units per year.

The company has invested $420,000 in this product and expects a return on investment of 8%.

Direct labor is a variable cost in this company.

-If every 10% increase in price leads to an 11% decrease in quantity sold, the profit-maximizing price is closest to:

A) $234.46

B) $214.69

C) $256.45

D) $78.50

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The management of Matsuura Corporation would like

Q3: All variable costs are included in the

Q4: The demand for products that are sold

Q5: Altona Corporation's vice president in charge of

Q6: Firestack Company's management believes that every 5%

Q8: The management of Mozdzierz, Inc., is considering

Q9: Eckhart Company uses the absorption costing approach

Q10: Bourret Corporation is introducing a new product

Q11: Raymond Company estimates that an investment of

Q12: The optimal markup on variable cost:<br>A) increases